Industry News

RELATED STORIES

The Evolution of Physical Security Technology in the Supply Chain Industry - SupplyChainBrain

The seamless operation of supply chains, which ...

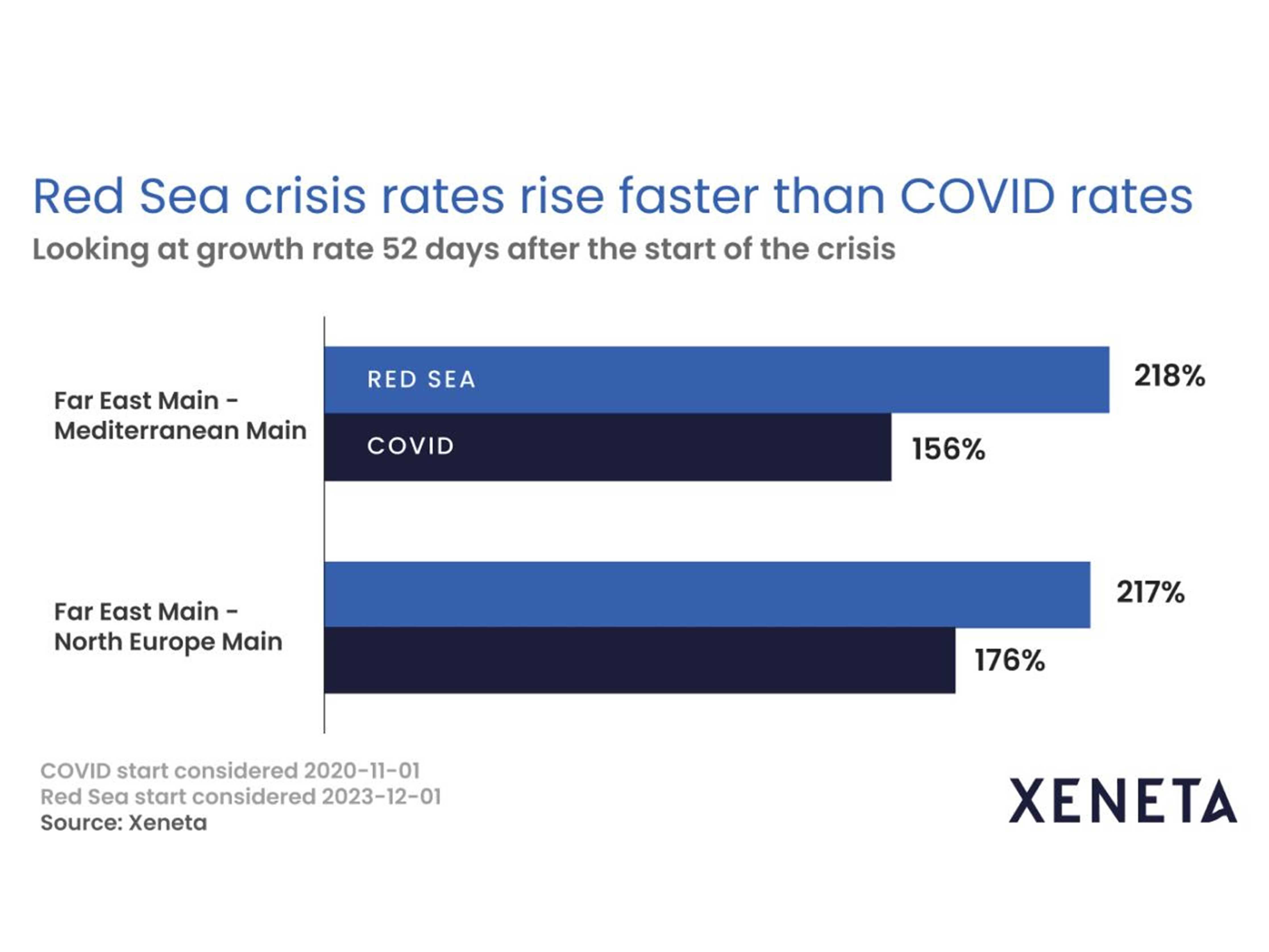

Know MoreRed Sea crisis impact on box rates more rapid than Covid-19 - Asean Lines

The Red Sea crisis has seen ocean freight rates...

Know MoreFreight crime on the up as gangs become more tech-savvy - The Loadstar

Internet-enabled crime and insider involvement ...

Know MoreHigh demand, low supply: Dubai faces warehouse shortage amid new business influx - Logistics Middle East

Dubai is facing a shortage of warehouse space, ...

Know MoreVGM container weight mis-declaration 'rampant at most ports', say forwarders - The Loadstar

Container carriers are dealing with widespread ...

Know MoreCMA CGM announces overweight surcharge from Middle East Gulf to Europe and Mediterrannean - Container News

CMA CGM announced it will implement a new overw...

Know MoreBleak outlook for box trades as demand weakens prior to Golden Week - The Loadstar

Export bookings leading up to China’s Gol...

Know MoreShip queue grows at both ends of Panama Canal and congestion builds - The Loadstar

Draught limits on vessels seeking passage throu...

Know MoreOver 60% of Logistics Companies Are Investing in Supply Chain Management Systems-SupplyChainBrain

Almost two-thirds of logistics companies (64%) ...

Know MoreGrowing India-UAE trade flows to benefit from domestic currency invoicing - The Loadstar

After a free trade deal last year, India and th...

Know MoreAir cargo market still weakening while players search for optimism - The Loadstar

News that airlines are starting to park some fr...

Know MoreBox rates to Gulf and S America rise as Asia-Europe/US prices falter - The Loadstar

Container freight rates from China to ’em...

Know MoreUp to Dh5,000 fine for owners of some vehicles who fail to register in tracking system before October 30 - Khaleej Times

The Federal Authority for Identity, Citizenship...

Know MorePlot a (positive) course for air freight rates...if you dare - The Loadstar

Amidst the economic doom and gloom, with claims...

Know MoreImports Continue Slow Climb Despite Cuts in 2023 Forecast - The Maritime Executive

The Global Port Tracker has not yet forecast th...

Know MoreSome ocean trades stabilising, but transatlantic rates still falling - The Loadstar

Container spot rates from North Europe to the U...

Know MoreUAE announces fees on international imports in 2023 - Arabian News

The UAE is set to introduce new import rules, s...

Know MoreChina's Lockdowns are Over, but its Shipping Outlook is Still Mixed- The Maritime Executive

Beijing’s on-and-off COVID lockdowns crea...

Know MoreOcean carriers plan to blank half their sailings from Asia, post-CNY - The Loadstar

Against a background of extremely weak demand f...

Know MoreAirfreight loses as shippers switch to cheaper ocean routes to save costs - The Loadstar

Shippers are merrily switching modes, back to s...

Know MoreProtests at China lockdowns spread, with supply chains looking vulnerable again - The Loadstar

Anti-lockdown protests have broken out across m...

Know MoreBlack Sea ro-ro operations adapt to the new normal as companies seek opportunities - The Load Star

War in Ukraine has forced the re-routing of car...

Know MorePort of Felixstowe strike could see air cargo demand rise further: Air Cargo News

Strike action at the UK’s biggest contain...

Know MoreWhy container ships probably won't get bigger: BBC

When the Ever Ace, one of the largest container...

Know MoreConsumers Prefer Personal Touch, Predictability, Over Super-Fast Delivery

To successfully ride the bucking growth of e-co...

Know MoreAir freight 'turned upside down' as capacity slumps and rates climb

Air freight capacity has indeed shrunk, accordi...

Know MoreRobotics in Warehouses- Enabling smarter and more cost-efficient logistics

Warehouses are the heart of supply chains and a...

Know MoreDP World reports strong volume growth of 17.1% in 2Q 2021

DP World Limited handled 19.7 million TEU (twen...

Know MoreMaersk to redesign its ocean network in West & Central Asia

Maersk is redesigning its ocean network in West...

Know MoreDP World acquiring Imperial Logistics for $890m expanding Africa footprint

DP World has announced an offer to acquire Sout...

Know MoreSecondhand Containership Market Heats up in 2021 driven by demand

Skyrocketing container shipping freight rates a...

Know MoreDP World acquires leading US-based supply chain solutions provider - GCC Ports

DP World announces the acquisition of 100 per c...

Know MoreHapag-Lloyd and ONE join Maersk’s blockchain platform

Two of the largest container carriers in the wo...

Know MoreHapag-Lloyd to provide full transparency on vessel arrivals.

With this initiative on schedule reliability, H...

Know MoreJust when you think shipping costs can’t go higher, increasing fuel cost are going to push prices up for shippers.

The price of Brent crude topped $72 per barrel ...

Know MorePort of Shenzhen faces severe congestion: container-news.com

The congestion at the Port of Shenzhen, China, ...

Know MoreHapag-Lloyd further expands its container fleet: 60,000 TEU of standard containers ordered- gccports.com

The sharp increase in demand has led to a short...

Know MoreGlobally, container manufacturing is controlled by three companies. Here is an insight into how this is impacting the global supply chain.

Never before has the humble ocean shipping cont...

Know MoreUAE to allow investors full ownership of companies from June 1 - Khaleej Times

The landmark reform was originally slated to ro...

Know MoreLogistics Passport: A game-changer for Dubai trade.

The WLP will be playing an instrumental role in...

Know MoreDesperate shippers swallow contract rates at double 2020 Levels - container-news.com

Early indications from the annual contract nego...

Know MoreVolatility in the shipping market likely to continue till Q4 - Sea Trade Maritime News

In a trading update for Q1 2021 Maersk signific...

Know MoreUAE economy performs better than expected, on track towards recovery in 2021 - Khaleej Times

The UAE economy performed better than expected ...

Know More2020 – A year of remarkable turnaround for container shipping

Due to the change in shopper behavior during th...

Know More2021 Trends In Retail Automation And Store Supply Chains

Some container vessels have been sailing from A...

Know MoreContainer shortages the biggest disrupter: where are all the empty boxes?

Some container vessels have been sailing from A...

Know More